VAT Registration

Part of our Austria company formation service is to register your company for VAT.

With a purchasing power that is amongst the highest in Europe, Austria is an attractive country to start a business in. Independent studies show that Austrians place a high value on price, brand, and quality. Austria’s corporate tax is 25% and there are no other local income taxes, making its corporate taxation model more transparent than Germany which buffers its supposedly low corporate tax with additional municipal taxes. Austria’s economy is stable, and eCommerce is widespread, boasting 5 million online shoppers.

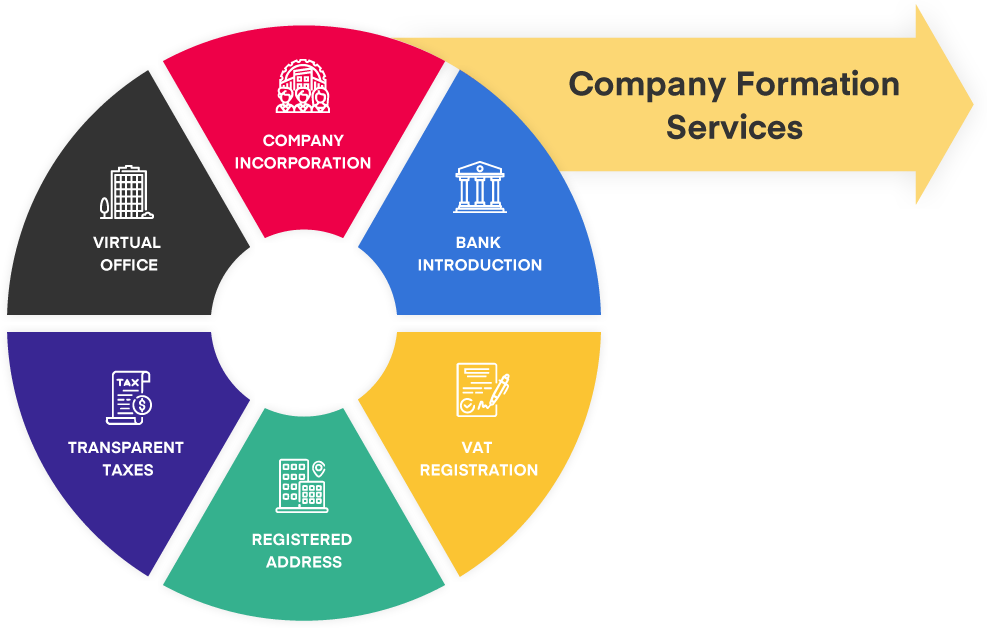

Our all-inclusive Austrian company formation package provides you with all you need to incorporate and run a company in Austria, including a bank introduction and VAT registration.

.png)

Austria has a robust local infrastructure and a stable economy. An Austrian GmbH (Limited Liability Company) is a prestigious company to hold due to the high initial share capital required to open one — €35,000, of which 50% must be paid upfront. The country has numerous double-taxation treaties in place, allowing for reductions in withholding taxes depending on the treaty being invoked. Foreign withholding taxes can be credited against the Austrian Corporate Income Tax (CIT).

Part of our Austria company formation service is to register your company for VAT.

We will introduce you to a local bank account to be able to incorporate your business in Austria.

Austria offers quite a few different company types.

The most common type, however, is the GmbH or Limited Liability Company.

It is not necessary to have a local office.

Austria offers numerous incentives ― including grants and subsidies — to attract and encourage foreign investment into the country. These incentives apply to R&D, SMEs, startups, direct investment and promotion of technological advances.

WHT is 28% for non-residents but can be reduced according to existing tax treaties.

See our step by step process once you purchase this item.

How it Works Austria Company One-Stop-Shop

Austria Company One-Stop-Shop

We provide everything you need to form a company in Austria so that you can start operating your new business as fast as possible.

On-Time Delivery

On-Time Delivery

We will have your Austria-based company ready for you in as little as 52 days.

Best Customer Support

Best Customer Support

Our team of company formation experts will advise you on anything and everything you need to properly incorporate your Austrian company.

“Austria is an excellent economy to start a business in and Start My Business made the process really easy for me.”

“Thanks to Start My Business, I was able to form up my GmbH in Austria with no complications. They took care of every single thing for me.”

“The Vienna virtual office is a real dream. Thanks to Start My Business, I can run my business remotely and only “step into” my office in Vienna once a day to check on anything urgent.”

Simply add the product you need to your shopping cart and then check it out to start your Austrian company formation process.

We will send you some simple questions for you to fill in so that we can properly set up your new company in Austria.

Let us do the work to set up your Austrian company. This will include a really quick and easy identity check where you’ll need your ID or passport to hand.

Once your company has been formed, you can officially start doing business in Austria!