VAT Registration

We will file your VAT application to the Swedish Tax Office (Skatteverket) if you wish to be registered for VAT.

Sweden has a long reputation as a stable economic environment in which to live and do business. Except for sole traders, all forms of businesses must be registered with the Swedish Companies Registration Office (Bolagsverket). According to an analysis by Santander Trade, “Sweden is a consumer society”, driven first by price and then by quality. The average salary in Sweden is just under €40,000, making it a fairly affluent society to do business in.

We provide ready-made shelf companies in Sweden, which means you won’t need to fork over the €2,400+ share capital for a limited company or much higher than that for a public limited company. We can also take care of registering for F-Tax (Swedish corporate taxation) and VAT with the Swedish Tax Office (Skatteverket).

.png)

Sweden is known for its high quality of life and excellent healthcare. Sweden has a high level of education with 83% of adults aged 25 – 64 having a secondary education. It is a consumer society, eager to accept new products that are priced well and of high quality. It is a politically stable economy.

We will file your VAT application to the Swedish Tax Office (Skatteverket) if you wish to be registered for VAT.

We will arrange an online banking solution for you to be able to do business within Sweden.

If you choose this add-on, we will give you a physical registered business address in Stockholm, Sweden.

If your board does not have a Swedish citizen on it, you will need to make use of a Process Agent Service where legal notifications and other formal communications can be sent and dealt with. This is a legal requirement.

One or more legal entities can start a limited company in Sweden. Initial share capital of SEK 25,000 (approx. €2,400) is required . The company must then be registered with the Swedish Companies Registration Office and the Swedish Tax Agency.

At least three directors, minimum share capital of about €50,000, and the MD and 50% of the board must be present in the European Economic Area.

Both partners are personally liable for debts, joint and several.

At least one partner is liable for all debts, and the other has limited liability.

Sweden has strict laws regarding employment. It is advisable to seek legal advice before entering into an employment contract with someone.

See our step by step process once you purchase this item.

How it Works Sweden Company One-Stop-Shop

Sweden Company One-Stop-Shop

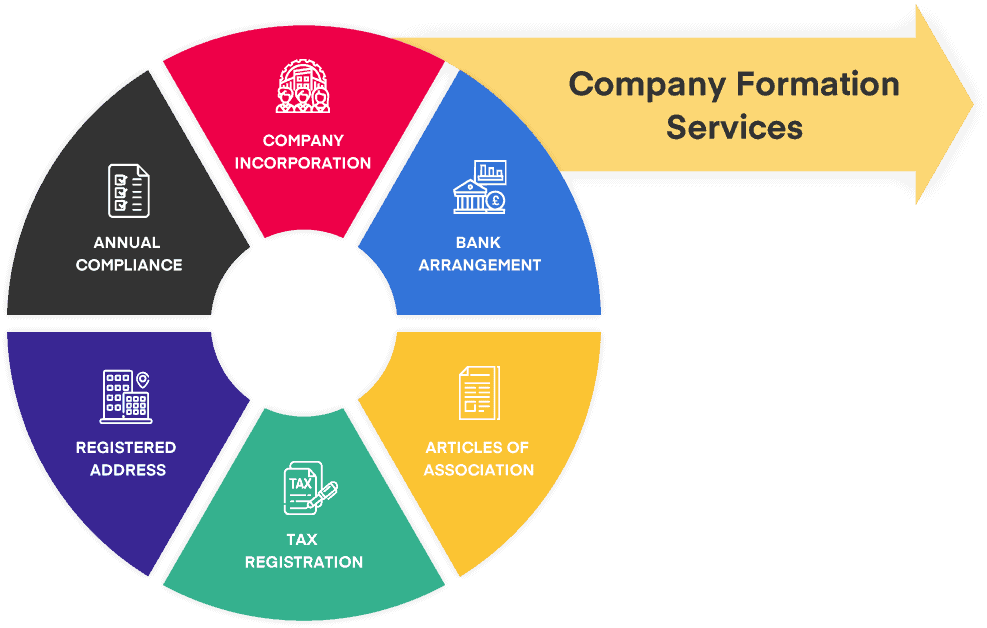

We provide everything you need to form a company in Sweden, including online bank arrangement, VAT Registration and a Virtual Office.

On-Time Delivery

On-Time Delivery

Depending on the add-ons you choose, we will have your Sweden-based company ready for you in 21 days.

Best Customer Support

Best Customer Support

Our team of company formation experts will advise you on anything and everything you need to properly incorporate your Sweden-based company.

“Sweden is a wonderful country and it was great to have Start My Business’s assistance in setting up a business here.”

“Getting my Swedish company set up was so fast using Start My Business’s service.”

“I do not speak Swedish but that wasn’t a problem at all using Start My Business’s company formation service. They took care of everything for me.”

Simply add the product you need to your shopping cart and then check it out to start your Sweden company formation process.

We will send you some simple questions for you to fill in so that we can properly set up your new company in Sweden.

Let us do the work to set up your Swedish company. This will include a really quick and easy identity check where you’ll need your ID or passport to hand.

Once your company has been formed, you can officially start doing business in Sweden!