VAT Registration

Part of our Luxembourg company formation service is to register your company for VAT if you choose to do so.

Contrary to popular belief, Luxembourg is not a “low-tax” country. In fact, its taxes are, on average, quite high. However, if your company qualifies for a particular structure, the taxation rates can be phenomenally low. This is why such enormous corporations as Regus and AdvanziaBank, to name a few, have made Luxembourg their headquarters. This low-tax structure is called a Soparfi and it is one of the packages we offer in our Luxembourg Company Formation service.

We can incorporate your Luxembourg limited company (SARL) and additionally set up your Soparfi (holding and financing activity) to make use of Luxembourg’s tax-efficient laws. Our add-ons provide additional robust features to make the most of your Luxembourg business.

.png)

Luxembourg is a popular location for companies fitting into the intricate and very specific category of Soparfi companies — a special type of holding or financing company which benefits from a highly tax-efficient structure. The Soparfi is not a legal entity in itself but is usually incorporated using a joint-stock (SA) or private limited (SARL) structure. Soparfi dividends are exempt from tax, and there are sometimes other tax benefits for profits and dividends. Luxembourg also offers benefits for Private Wealth Management companies (SPFs). SPFs do not need to pay corporate taxes, municipal income tax or net worth tax.

Part of our Luxembourg company formation service is to register your company for VAT if you choose to do so.

We will arrange a Luxembourg online bank account for you in only a matter of days.

Registered address in Luxembourg City

If you choose this add-on, we will give you a physical registered address in Luxembourg City.

If you choose our administration add-on, we will conduct basic legal services on your behalf, sign and send documents as needed and do bank transfers as per your instructions.

Luxembourg offers multiple possible structures for a business, including:

Joint-stock company (SA)

Limited liability company (SARL)

General partnerships

Limited partnerships

Special limited partnerships

Branches of overseas companies

A minimum share capital €12,000.

A minimum of one director

A registered office in Luxembourg

Audited accounts according to company size.

If you are a trader (commerçant) who is not otherwise regulated, then no.

Some industries are required to provide evidence of certification of qualifications, such as hotel, restaurant, catering, real estate, certain skilled trades, etc.

Once you check out the package you desire, our questionnaire will walk you through everything you need to finish setting up your company, including providing any evidence required to do that.

Professionals in the Financial Sector (PFS) require a license to operate in Luxembourg. Our questionnaire will walk you through all the necessary steps to being able to operate successfully from Luxembourg regardless of the sector you’re in.

Luxembourg has a history of low inflation and is considered a stable, high-income economy. About 80 per cent of its yearly GDP comes from the financial sector. Since 2002, the Luxembourg government has engaged in programs to encourage foreign investment.

See our step by step process once you purchase this item.

How it Works Luxembourg Company One-Stop-Shop

Luxembourg Company One-Stop-Shop

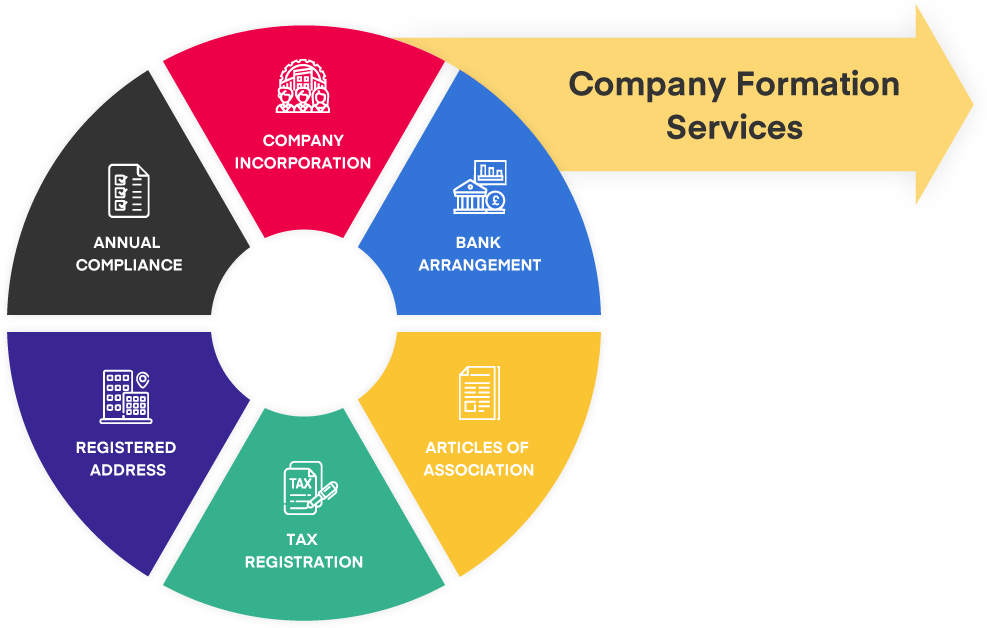

We provide everything you need to form a company in Luxembourg, regardless of whether you want to form a SARL (Limited Liability Company) or the special low-tax status vehicle called Soparfi (a special type of “holding” company).

On-Time Delivery

On-Time Delivery

Depending on the add-ons you choose, we will have your Luxembourg-based company ready for you in approximately 14 days.

Best Customer Support

Best Customer Support

Our team of company formation experts will advise you on anything and everything you need to properly incorporate your Luxembourg-based company and navigate Luxembourg’s complex roads towards a highly tax-efficient business. If you qualify, the journey is worth it.

“Setting up a business in Luxembourg was tremendously complicated and Start My Business helped me simplify it completely!”

“Start My Business advised me on everything I needed if I wanted my financial services business to qualify for Soparfi status. ”

“These Start My Business guys really know what they’re doing! I needed to start a Sarl and Start My Business made it easy for me.”

Make it easier to do business in Luxembourg by supplementing your package with add-on features.

Simply add the product you need to your shopping cart and then check it out to start your Luxembourg company formation process.

We will send you some simple questions for you to fill in so that we can properly set up your new company in Luxembourg.

Let us do the work to set up your Luxembourg company. This will include a really quick and easy identity check where you’ll need your ID or passport to hand.

Once your company has been formed, you can officially start doing business in Luxembourg!